What You Need To Know

- City Center Law Group, formerly Novara, accuses Progressive Michigan of helping its insurance division plan a mass-move to a new firm.

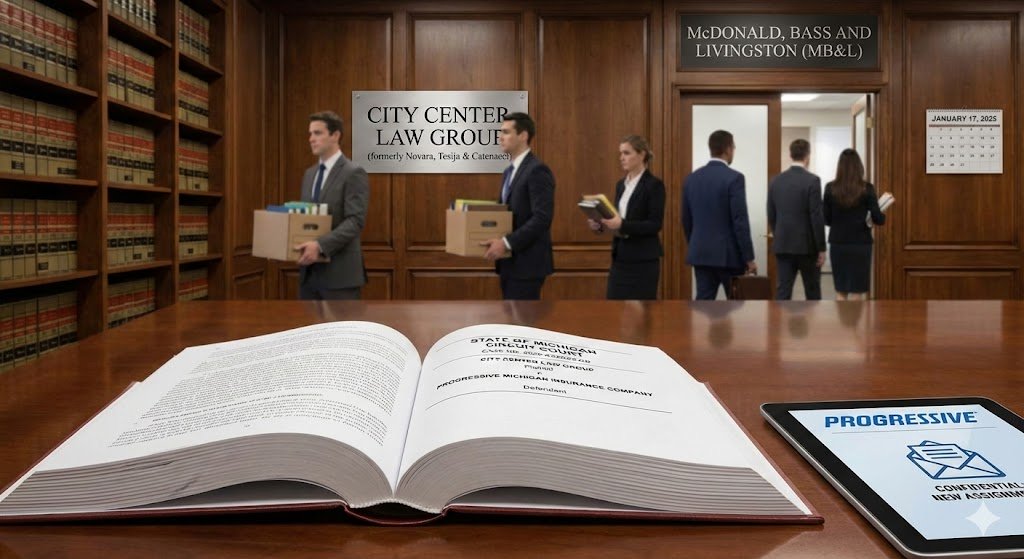

- Novara’s entire insurance division left the firm on January 17, 2025.

- Progressive was formerly one of Novara’s largest clients, with the firm handling around 1,500 of its insurance cases each year.

A Michigan law firm has filed suit against Progressive Michigan Insurance Company, accusing the insurer of engaging in secretive actions that aided a mass exodus of its insurance law division earlier this year.

The plaintiff, City Center Law Group, was known as Novara, Tesija and Catenacci (“Novara”) at the time of the alleged incident. According to the suit filed in a Michigan Circuit Court, Novara was formerly a small law firm that focused primarily on employee benefits, ERISA and labor law. In 2018, however, Novara hired attorneys and defense lawyers to launch an insurance defense division. By 2025, Novara reportedly employed more than 100 attorneys and 80 staff members, managing over 1,500 active insurance defense cases for Progressive each year.

The lawsuit filing recounts the process of Novara becoming an approved legal provider for Progressive, which it says involved submission of its W-9, a list of insurance defense attorneys, proof that the firm had D&O coverage and proof of malpractice insurance for each attorney. After providing this information, Novara gained approval from Progressive in 2019.

In this partnership, Novara agreed to act as outside legal counsel for Progressive and its insureds in Michigan insurance litigation.

The plaintiffs claim that this business relationship allowed Progressive familiarity with the firm’s billing system, staffing procedures, strategies and proprietary case data.

Novara also claims that it received a “Welcome Packet” from Progressive after being retained, which laid out strict confidentiality and information-handling protocols. These guidelines allegedly included a requirement for the firm to securely destroy or return all Progressive materials at the end of each legal matter to maintain the insurance company’s full control over private policyholder information.

Novara maintains it upheld these standards throughout its relationship with the insurer. However, the firm accuses Progressive of diverting from its own protocols in 2024 and 2025 by secretly sending new assignments, calendar invites and communications directly to attorneys at McDonald, Bass and Livingston (MB&L), even though that firm was allegedly never vetted by Progressive in the same way Novara was.

The plaintiff claims Progressive continued these actions, without notice to Novara, for eight to nine months leading up to a surprise mass exodus of the law firm’s insurance division.

Unbeknownst to Novara, MB&L had been quietly formed by attorneys Marc McDonald, Jason Baas, Frederick Livingston, Timothy Kubik and others who were — prior to the mass-exit — employed by Novara.

The suit states, in part: “Unbeknownst to Novara, its (now former) attorneys Marc McDonald, Jason Baas, Frederick Livingston, Timothy Kubik, and others embarked on a scheme to defraud Novara and secretly organize a mass, sudden exit of the entire Insurance Division on January 17, 2025, including attorneys, secretaries, paralegals, billing staff, and the controller, to a new law firm they were establishing: MBL. To accomplish their mission, Baas and McDonald began working with vendors and clients, including Progressive, April 2024 or earlier. However, it was not until January 17, 2025, when the entire Insurance Division abruptly informed Novara of their departure that Novara began to slowly discover the extent of the scheme, in which Progressive played an integral role.”

The suit alleges that Novara’s now-former insurance division engaged in a months-long planning stage, during which attorneys and billing staff did not log certain billable hours, which allowed them to transfer the billing and payment for that work to MB&L. During a review of its accounting records, Novara reportedly discovered that the insurance division was holding a significant amount of these billings as “work in progress,” so they could be diverted to MB&L.

Novara says that as one of its largest insurance clients, Progressive’s participation was integral to the success of MB&L’s plan.

The suit lays out the accusations against Progressive: “Upon information and belief, beginning as early as April 2024, Progressive employees started including email addresses associated with a domain name for the not-yet- incorporated firm MBL on communications involving active Novara cases, demonstrating that Progressive was aware of, and coordinated with, attorneys who still were employed by and compensated through Novara in preparation for their planned surprise departure… Upon information and belief, by July 2024, Progressive was fully engaged in facilitating the transition of Novara’s attorneys to MBL and providing confidential materials to MBL, including onboarding documentation and internal data to support the creation of MBL as a separate, new law firm, all while Novara remained completely unaware of the scheme and unaware of MBL’s existence.”

Novara accuses Progressive of scheduling “Monthly SIU MC Litigation/Attorney Status Discussion” meetings, including MB&L addresses, months before the new firm was incorporated in order to ensure the attorneys who planned to leave Novara were integrated into the insurer’s litigation workflow. These attorneys were still allegedly employed by Novara at the time of these communications.

Novara claims Progessive was aware throughout this process that the law firm had no idea of the attorneys’ plans to leave and take the entirety of its insurance division staff — as well as the cases and clients it handled — to MB&L.

The lawsuit also details several other alleged actions taken by Progressive Michigan employees that Novara says aided in the decimation of its insurance division.

Novara accuses Progressive of aiding and abetting breach of fiduciary duties, civil conspiracy to aid and abet breach of fiduciary duties and unjust enrichment.

The firm has requested the court enter judgment against Progressive and award damages in excess of $25,000, plus plaintiffs’ costs and attorneys’ fees. It has also asked the court to order Progressive to provide a full accounting of all funds, payments and transactions relevant to the allegations.